In today’s fast world, life moves quickly. Sometimes you need to drive a car right now, but you don’t have insurance for it. Maybe you want to borrow your friend’s car for a weekend trip. Or perhaps your regular insurance does not cover a new car you just bought. Or you need to drive a rental car for a few days. This is where a temporary car insurance app comes in very handy.

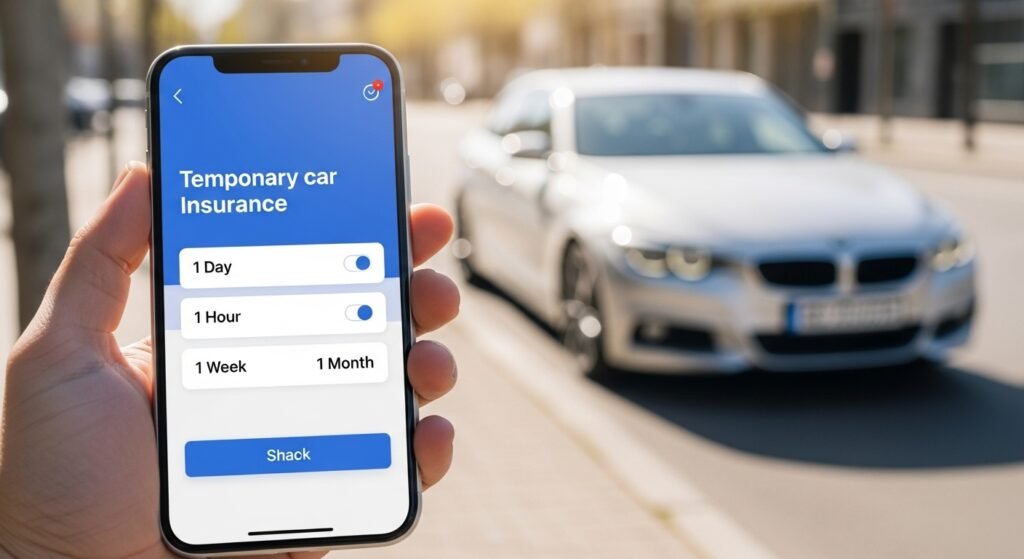

A temporary car insurance app lets you get car insurance fast – often in minutes – right from your phone. No need to visit an office or wait for days. You open the app, answer a few simple questions, pay, and you are covered. It’s quick, easy, and made for people on the go.

This article explains everything about temporary car insurance apps in simple words. We will cover what it is, how it works, the benefits, when to use it, and tips to choose the best one. By the end, you will know if this is right for you.

What Is Temporary Car Insurance?

Temporary car insurance is also called short-term car insurance. It gives you protection for a short time – from as little as 1 hour to a few weeks or even a month.

Normal car insurance lasts 6 months or 1 year. But temporary insurance is different. You only pay for the days or hours you need. This makes it cheaper if you don’t drive a lot or only need cover sometimes.

Many people think temporary insurance is only for borrowing cars. But it can also help when you buy a new car, drive a rental, or test drive a vehicle.

In some places like the UK, companies offer very flexible options – even hourly cover. In the US, true daily or hourly temporary insurance is less common from big companies. But some apps and services provide on-demand or pay-as-you-go options that work in a similar way. They let you activate cover fast when you need it.

Why Use a Temporary Car Insurance App?

Apps make everything easier. Here are the main reasons people love temporary car insurance apps:

- Speed: You can get a quote and buy cover in under 5-10 minutes. Some apps say “covered in minutes.”

- Convenience: Do it from your phone anywhere – at home, on the road, or even in a parking lot.

- Flexibility: Choose exactly how long you need cover. Start from 1 hour, 1 day, or up to 28-60 days.

- No Long Commitments: No need to sign up for 6 months. Pay only for what you use.

- Digital Proof: Get your insurance certificate right in the app. Show it on your phone if police ask.

- Easy Management: Change dates, extend cover, or view documents anytime.

These apps use modern technology. They check your details quickly and give instant decisions. This is much better than old ways of calling agents or filling long forms.

How Does a Temporary Car Insurance App Work?

Using an app is simple. Here is a step-by-step guide in easy words:

- Download the App: Go to your phone’s app store (Google Play or Apple App Store). Search for the temporary insurance app and download it for free.

- Sign Up: Create an account with your email or phone number. It takes seconds.

- Enter Details: Tell the app about yourself – your age, driving history, and license details. Then add the car info – number plate (registration), make, model, and who owns it.

- Choose Cover Time: Pick how long you need insurance. Options can be from 1 hour to many days.

- Get a Quote: The app shows you the price right away. Prices depend on your age, driving record, the car, and how long you want cover.

- Pay and Get Covered: Pay with card or other easy methods. Once paid, you are insured instantly. The app sends proof of insurance to your phone.

- Manage on the Go: If you need more time, extend the policy with a few taps. View your policy anytime.

Many apps use smart systems to make quotes fast. They connect to databases for quick checks. This is why you get cover so quickly.

Who Needs Temporary Car Insurance the Most?

Many situations make temporary insurance perfect:

- Borrowing a Friend’s or Family’s Car: Your insurance may not cover other cars. Temporary cover fixes this fast.

- Test Driving a New Car: Dealerships often need proof of insurance before you drive off.

- Buying a New or Used Car: You need cover to drive it home from the seller.

- Renting a Car: Some rentals need extra cover, or your own policy may not include rentals.

- Learner Drivers or New Drivers: Some apps help young or new drivers get short cover to practice.

- Short Trips or Holidays: Going away for a weekend? Get cover just for those days.

- Van or Special Vehicles: Many apps cover vans, motorhomes, or learner cars too.

If you drive very little, temporary options save money compared to full-year insurance.

Benefits of Using Temporary Car Insurance Apps

Temporary apps have many good points:

- Save Money: Pay only for the time you use. No waste on unused days.

- Peace of Mind: Drive legally and safely. If something happens, you are protected.

- No Paperwork Hassle: Everything digital. No printing or mailing.

- Instant Access: Covered right away – important in emergencies.

- Good for Everyone: From young drivers to older ones, many apps accept different ages and records.

- Extra Features: Some apps let you add extras like breakdown cover.

- Eco-Friendly: Less paper, all on phone.

People say these apps changed how they handle short drives. They feel more free to borrow cars or try new ones.

Things to Watch Out For

Temporary insurance is great, but be careful:

- Not Available Everywhere: In some countries like the US, big insurers don’t offer true daily cover. Look for on-demand or pay-as-you-go services.

- Cost Can Be Higher Per Day: Short cover sometimes costs more per day than long policies. But overall, it’s cheaper if you need little time.

- Check Coverage Level: Make sure it’s comprehensive (full cover) if you want protection for damage to the car too.

- Read the Rules: Some apps have age limits or no claims rules. Always check.

- Avoid Fake Sites: Only use trusted apps from known companies.

Always compare a few apps to find the best price and service.

Popular Temporary Car Insurance Apps and Services

Many good options exist. Here are some well-known ones (based on what people use and like):

- Apps like Cuvva offer cover from 1 hour. They are fast and popular for borrowing cars.

- Veygo gives flexible cover, good for young drivers.

- Tempcover has app discounts and quick quotes.

- Dayinsure makes it easy to get cover on the go.

- Other services like Hugo provide on-demand activation.

Look for apps with good reviews on app stores. Check Trustpilot or other sites for real user stories.

Prices change based on where you live, your age, and the car. Get quotes from a few to see.

The Future of Temporary Car Insurance Apps

Technology gets better every year. Apps now use phones to check driving safely. Some link to pay-as-you-go where you pay for miles driven.

In the future, expect even faster cover, better prices, and more options worldwide. On-demand insurance is growing because people want things quick and simple.

Final Thoughts

A temporary car insurance app is a smart tool for modern life. It gives you quick, easy coverage when you need it most – on the go.

Whether you borrow a car, buy a new one, or just need short cover, these apps save time, money, and stress. They let you drive with peace of mind.

Next time you need insurance fast, try a temporary car insurance app. Download one, get a quote, and see how simple it is.

Disclaimer:

This article is just for information. It is not an ad or promotion. We do not sell insurance and do not get money from any app. Always check with the official insurance company before buying. We are not responsible for any problems or losses.

Explore More

- Sky Glass App: Control & Stream Your TV Easily

- Halfords App: Easy Car, Bike & Tech Shopping on Your Phone

- Joy App: Your Easy Way to Fun and Happiness